Employer of Record in Nigeria: Hire Employees With Zero Risks

- April 26, 2023

- Posted by: Mohammed Abiola

- Category: Business plans

Many international companies seeking to expand into the Nigerian market encounter difficulties relating to compliance with both state and federal laws of the country. PoweredUp Consulting is an indigenous firm that provides an employer of record to hire qualified employees and handle all that concerns payroll without your business’s physical presence in Nigeria. PoweredUp Consulting will handle compliance tasks, pay workers on time for you and help you expand your company by focusing on the core activities of your company. As an indigenous firm, we are conversant with the employment laws of Nigeria, tax policies, and the people to offer you the best service needed for your business to grow in Nigeria.

Do you need an employer of record in Nigeria to handle employment, payroll, taxes, immigration, and benefits that comply with the employment law of the country so you won’t breach the employment laws and you won’t break the bank? Contact PoweredUp Consulting today.

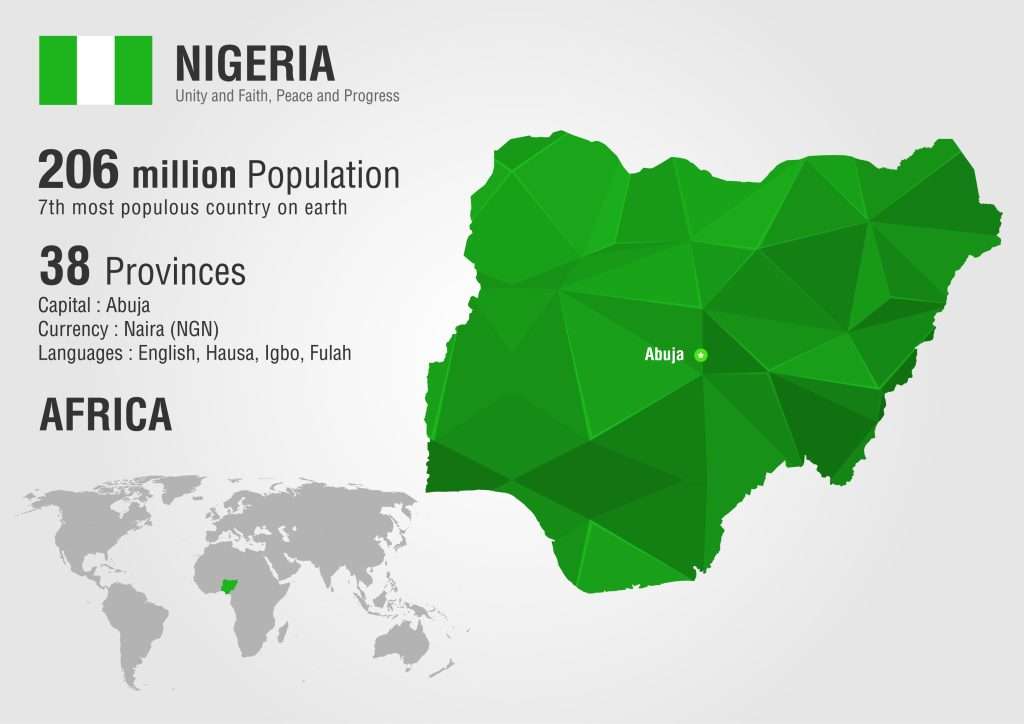

Nigeria’s Facts and Stats

Population – 223.8 million

GDP – 440.83 billion US dollars in 2021

Official language – English

Major languages spoken – Hausa, Yoruba, and Igbo

Capital – Abuja

Largest city – Lagos

Currency – Naira (₦)

VAT – 7.5% ()

Minimum wage – ₦30, 000 per month

Cost of living – low

How to invest in Nigeria with an Employer of record

Nigeria holds the prestige of being the most populous black nation in the world. A member of the African Union and regarded as one of the fastest-growing economies in the world. Nigeria is enriched with natural resources such as crude oil, iron, gold, and many more. Lagos State, dubbed “the Silicon Valley of Africa”, serves as the major destination for business owners who want to explore their investments in Africa. To add to that, Nigeria has an enormous labor force of skilled personnel both in administrative and tech needed for the smooth operation of your business. With English as an official language, doing business is easy as communication barriers are absent.

Engaging the services of an employer of record in Nigeria is a cost-effective and less risky route to operating your business in Nigeria in the comfort of your parent company. As an employer of record, PoweredUp Consulting will ensure your expectations are met by hiring quality workers and on-board employees to grow your team within a short time frame without your physical presence but you will be carried along with the process. Talk to PoweredUp Consulting experts today.

Employing in Nigeria

In Nigeria there are two classes of employees; worker and employee. The worker carries out unskilled tasks while the employee performs administrative tasks and other tasks that require educational training. Different laws apply to each of the groups. Contract terms in Nigeria can be fixed or indefinite and depend on the type of business. For all sets of workers, employers should draft contracts in written form that is in line with the laws and regulations of the country and should be signed by both parties to avoid fines from the authority. An employment contract should always include employees’ information, salary, compensation, benefits, and termination terms. Workers in Nigeria are paid in Naira.

Want to know more about employment in Nigeria? Get in touch with our experts today.

Nigerian Holidays

The holidays in Nigeria include:

New Year’s Day

Good Friday

Easter Sunday

Easter Monday

Id el Fitri

Inauguration Day

Labour Day

Democracy Day

Id el Kabir

Independence Day

Id el Mulud

Christmas Day

Boxing Day

Probationary period

There is no specified legal requirement or length for probation in Nigeria. Probations are permitted and the length of the probation is based on agreement between employers and employees. The probation period can be between 3 to 6 months however, 6 months probation period is the most common in Nigeria.

Paid Leaves in Nigeria

Pregnancy leave

Expectant employees are entitled to 12 weeks of maternity leave with a 50% pay of their average wage. The leave begins 6 weeks before the due date. Although the Labour Act does not make provision for paternity leave, in 2021 the federal government of Nigeria approved a 14 days paternity leave for male employees in the civil service, while states such as Lagos state and Enugu state provide paternity leave of 3 weeks and 2 weeks for the first two children respectively.

Sick leave

Employees in Nigeria are entitled to 12 days of paid sick leave per year.

Statutory leave

Employees are entitled to 6 days paid off per year after working for a particular employer for 12 months. The unused off days can be rolled over to the next year but must not exceed two years.

Payroll system in Nigeria

Bonuses

Bonus payment is not stipulated by the law. However, bonuses are paid based on the disposition of an employer as a reward for outstanding performance or in the form of an annual bonus. Paying bonuses helps to keep employees satisfied and improves productivity. There is no 13th-month bonus backed by the law in Nigeria. However, some companies pay a 13th-month bonus to their employees.

Overtime

There is no legal recognition of overtime in Nigeria. However, employers and employees should agree on the placement of overtime, and overtime pay which should be stated in the contract.

Working time

The standard working hours in Nigeria is 40 hours per week, 8 hours per day. There is a mandatory one-hour break for every Nigerian employee.

Payroll cycle

Options for payroll payment include weekly, bimonthly, and monthly. Most employers in Nigeria use the monthly payroll system.

Health Insurance in Nigeria

The Nigerian government makes provision for the National Health Insurance Scheme. Private companies do provide private health insurance benefits for their employees through the services of Health Maintenance Organisations.

Taxes

Employers are required to pay 30% as corporate income tax in Nigeria.

Employee income tax varies based on individual income rate and progresses with increments in salaries. Income tax ranges from 7% to 24%. Below is the breakdown of how income tax is paid.

NGN 300, 000: 7%

NGN 300, 000- 600, 000: 11%

NGN 600, 000 – 1.1 million: 15%

NGN 1.1 million – 1.6 million: 19%

NGN 1.6 million – 3.2 million: 21%

Above NGN 3.2 million: 24%

Social security

Employers and employees (earning NGN 30,000 and above) are required to make provision of a certain amount towards social security as stipulated in the law.

Employer provision

Pension scheme- 10%

Health insurance scheme – 10%

Workers’ compensations – 1%

Industrial training fund – 1% (an employer with more than five employees and has a turn over-rate of NGN 50 million)

Employee provision

Pension scheme- 8%

Health insurance scheme – 5%

National Housing fund – 2.5%

Termination of services

Termination of the employment process in Nigeria is dependent on the employment contract and the reason for termination. A notice of termination should be given by either the employer or employee for the termination to be acknowledged.

Notice period

Employees have the right to be notified when their services are no longer required by the employer. Also, employees should notify the company before terminating their employment. The notice period depends on how long an employee has been working for a company.

One day’s notice for a service of three months

One week’s notice for a service of three months to two years

Two weeks’ notice for a service of two to five years

One month’s notice for a service of more than five years

Severance pay

Severance pay is not mandatory as stipulated by law. Some employment contracts or engagement of collective bargaining agreements may conclude with severance pay. In case of breach of contract, employees are not given severance compensation.

Poweredup Consulting offers an efficient employer of record to manage your workforce in Nigeria. As an indigenous company in Nigeria, with our extensive knowledge of the Nigeria labor act laws both at the federal and state level and the market structure. We will ensure that all complexities relating to HR management, employment, and payroll are carried out in compliance with the laws of Nigeria. PoweredUp Consulting will bear the burden of running your business in Nigeria while you focus on the core operations of your business.

If you would like to learn more about how PoweredUp Consulting can help you hire and manage your employees in Nigeria. Do not hesitate to contact us.

Frequently asked question

Does working in a Nigeria require work permit?

Yes, expatriates who are foreign workers in Nigeria require a work permit to enable them to work effectively in Nigeria. If an expatriate is caught without a legally obtained work permit or an expired work permit, the expatriate is liable to 3 years in prison and a fine of NGN 500,000. To prevent actions from the local authorities, you should renew your work permit once expired.

Who is responsible for obtaining a resident and work permit?

Employers are required to obtain work and residence permits for their expatriate workers. An employer of record can handle this for you.

What is the validity of a work permit?

1 year

What are the required documents to apply for a work permit?

A formal application by the sponsoring employer in Nigeria.

A passport with at least two blank pages and valid for the next six months.

Proof of finance sufficiency.

Two valid passport photos.